Financial Advising Overview

Chevron Financial uses a holistic approach to the financial life of every client. We evaluate investments, risk tolerance, current financial path, large purchases, and future plans, wants, and needs to develop a financial plan and investment plan. While this may seem complicated, we've done our best to use cutting-edge software systems and detailed processes to simplify the client interface as much as possible. The desired result is best-in-class advising and planning from a process that feels simple and easy to use to the client. We will explain more about the pieces of our process below, but the core concept is to evaluate individual risk tolerance, evaluate existing portfolio risk tolerance, propose a portfolio that best matches the client, plan for a lifetime of financial well-being, implement the plans, and evaluate periodically.

Risk Tolerance Evaluation

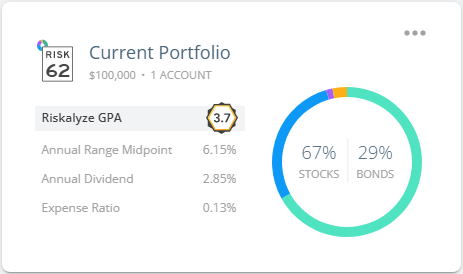

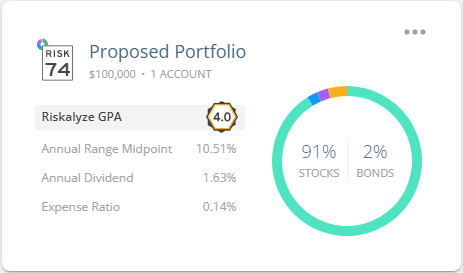

Chevron Financial uses a metric-based approach with cutting edge analysis software to combine judgement, experience, and data. To determine risk tolerance we use a system based on Prospect Theory, which won the Nobel Prize for Economics, to evaluate the risk tolerance on a scale of 1-99 for each individual as well as assign a risk number to any security or portfolio. This allows us to make sure the risk and potential downside, in 6-month intervals (and determined with a 95% probability range), is aligned with the comfort level of the client. In cases where need and risk aren't aligned it facilitates a discussion of potential changes that may provide a more favorable outcome.

While this all sounds complicated, a simple risk questionnaire uses real investment options to determine your risk comfort level. On the securities side all the work is done in the backend and the risk number for a portfolio or security is displayed like a speed limit sign with a range from 1-99. In fact, it's so simple that you can complete the questionnaire and get your risk number in just a few minutes, right now. Click on the link below to determine how risk tolerant you are.

The risk number is based on the 95% confidence interval of the range of performance the portfolio or security has historically had. It allows us to determine, with 95% confidence, the range the portfolio or security is likely to fall within during any given 6-month period. This allows us to prepare investors for the range of swings that are likely and normal in a portfolio. If the range of swings makes the investor uncomfortable then it's likely that the portfolio has more risk than the investor is tolerant of, and thus needs to be adjusted. While the risk number can account for 95% of the risk in a portfolio, there still exists 5% that cannot be accounted for. These events, like the housing market crash of 2008 and Covid pandemic of 2020, cannot be modeled but that doesn't mean there isn't a plan for what to do when they occur.

Investments Proposal

When evaluating portfolios and securities within our system we look at two key metrics: the risk number (described above) and the GPA. While the risk number determines the downside range a portfolio may experience in a 6-month window, the GPA measures how well a portfolio has returned for a given amount of risk. If two portfolios have similar levels of risk then the portfolio with the higher GPA would have historically performed better than one with a lower GPA. Conversely, if two portfolios have significantly different risk numbers but very similar performance then the one with the lower risk number would have a high GPA, as it produced greater returns for the amount of risk it took on.

To provide simplified insight to clients we want them to know and understand three main things about their investments:

- Their risk number and whether the risk of their portfolio is aligned with their risk tolerance

- The GPA of their portfolio, which is the risk-adjusted return it historically has provided

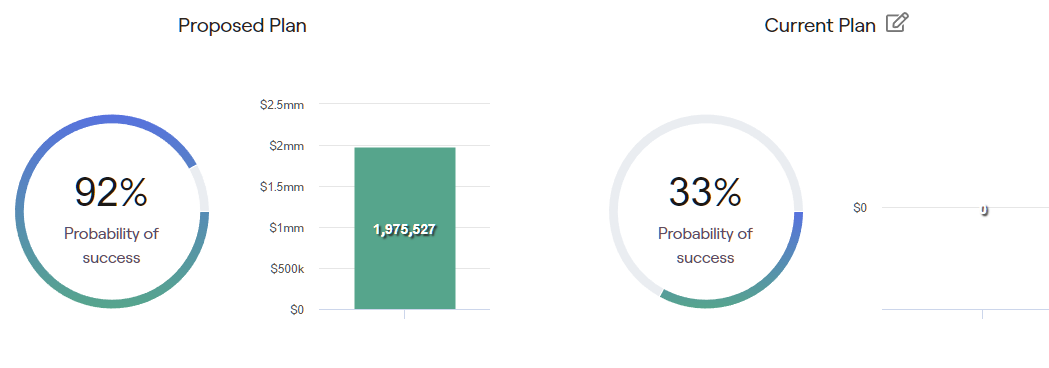

- Their probability of success in meeting their financial goal, or in other words, the probability of not needing to change their plan

Financial Planning

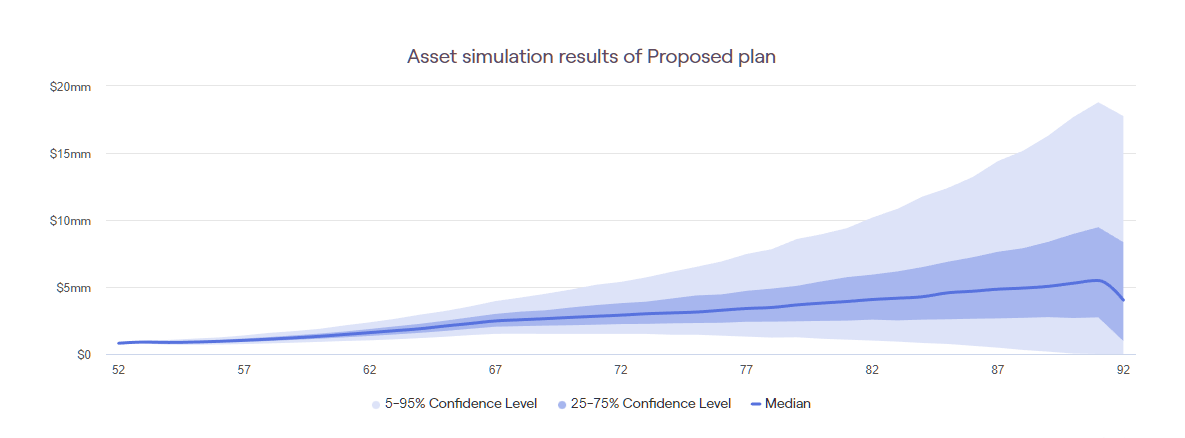

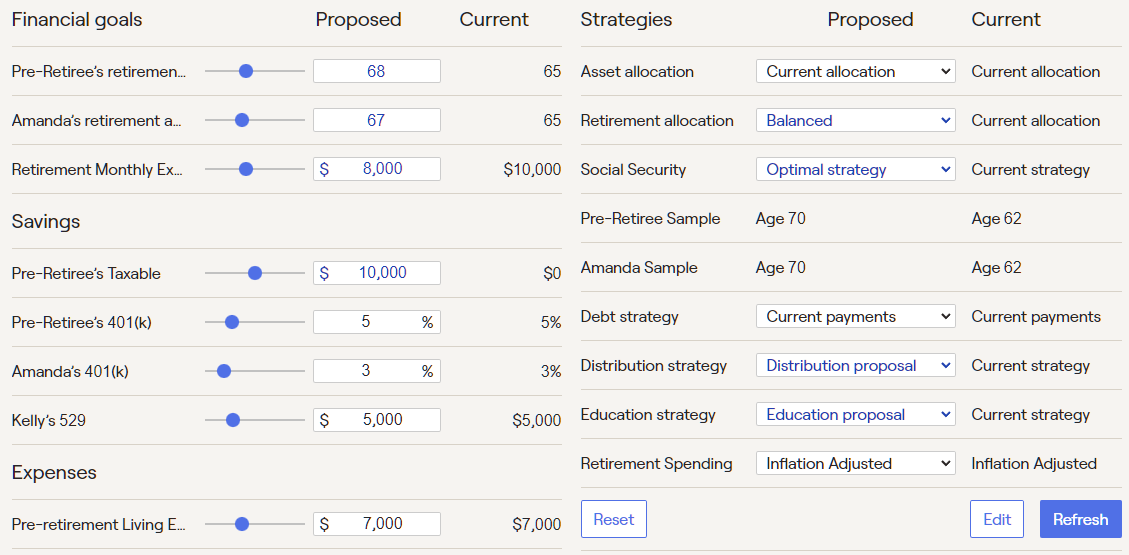

Financial planning allows us to look at hundreds of inputs with thousands of options to determine the likelihood of success in meeting a financial goal, which is usually to not run out of money in retirement. We are able to input where you are and the path you're currently on and line it up with where you would like to be at some point in the future and run simulations to determine if you are likely to meet your goal or not. We use Monte Carlo simulations, which run 1,000 simulations for your financial life every time we make an adjustment to an input or the plan. For example, one page of the tens we use shows the options to the retirement planning piece of the financial planning puzzle:

Our financial planning system provides comprehensive analysis and recommendations for investments, retirement, insurance, education expenses, social security optimization, loans, taxes, estate planning, liquidity, and more. We are also able to stress test plans against a wide range of risks, like tax rates, social security changes, longevity of life, inflation, health care costs, asset returns, and a short-term market drop. Getting a financial plan completed correctly takes significant time and expertise on the part of the advisor, but the outcome we want clients to focus on is the probability of success, which is another way of saying the odds they will meet their goal without changing anything about their plan.

Implementation

We implement a financial plan by outlining the key areas to make changes during the coming year. Typically the focus is on 3-5 items to change habitually and a couple things to change at specific points in time, such as investment contributions for maximum tax benefit. This part is often the most difficult for the client because humans are creatures of routine and habit and we don't like to change things. To help with this we use quarterly check-ins, bi-annual discussions, and an annual comprehensive evaluation to create and drive change over time. One of the largest ignored benefits of an advisor is that it's someone able to look at a client's financial picture without emotional investment and provide objective input, much like a sponsor in a 12 step program or a professor in college.

For investments we have partnered with Altruist to be the custodian of our client funds. Altruist as a custodian is the same as other advisors using Charles Schwab, Fidelity, TD Ameritrade, etc. We selected Altruist because they have done the best job of making it easy to do business with them in our view. It's extremely simple to open accounts, move money in and out, monitor performance, and more. While you may not have heard of Altruist before now, they are supported financially by Vanguard and Venrock, which is a venture capital firm founded by the Rockefeller family. Their view is that the market needs more than 2 or 3 quality options for RIA custodians and Altruist intends to lead the way in a more modern, digital approach to financial management. Learn more about Altruist here: Altruist PDF or at www.altruist.com.

Ongoing Optimization

Our investing tools allow for ongoing optimization of portfolios. Over time the balance between riskier and lower risk securities will change. Likewise, some securities will perform better than others. Part of the plan to mitigate risk over time is to keep a portfolio in balance. Our cutting-edge rebalancing tools allow us to rebalance portfolios entirely, any time it's necessary. For tax-advantaged accounts this can occur as often as daily. Older portfolio management tools would rebalance quarterly or maybe monthly, but we are able to rebalance based on triggers in the portfolio, not time, to best keep alignment with targets.

We are also able to change the models used in portfolios on the fly, so as we change the composition of the portfolio designed for a client it's easy and fast to push the change to the account. For accounts that do not have tax advantage and could generate taxable events with trades we use tools to make the best overall decision with minimal tax impact. This way clients don't end up with taxes owed on many short-term capital gains transactions and a surprise tax bill.

Our investment system is also able to manage cash in a portfolio in multiple, advanced ways. For clients in retirement we are able to set aside a certain amount of cash at all times, ready for withdrawal. Or for a single large purchase we can easily raise and set aside a fixed amount of cash. Or for younger clients looking to grow investments we are able to make sure unnecessary amounts of cash aren't sitting on the sideline without being invested. All these help clients work toward their specific goals and keep the various forms of drag from impacting client performance: tax drag, cash drag, performance drag, balance drag, etc.

Periodic Review

Chevron Financial uses a structured contact model with an open door policy. We would love to hear from you and help you with a question or concern at any time of the year. We especially love helping with financial problems, like getting the best lease deal on your business vehicle lease or setting a budget for a home purchase. Please reach out to us if you ever have a need we might be able to help with. If we don't know the answer we will research it or ask someone who should. If we can't come up with an answer we will tell you. But we give you our word we'll take our best shot at everything you ask of us.

Outside of our open door policy we will attempt to initiate contact throughout the year in the following manner:

- Quarterly automated email check-ins on your confidence in the market and your financial future

- Annual discussion check-in to discuss how things are going and any concerns you may have

- Annual detailed planning and review (offset 6 months) to update the financial plan and investment targets

We reach out to clients at least 6 times per year but love to hear from clients with help at any time. Our goal is to build a long-term relationship working with our clients to achieve their financial goals, even with the things we help with are not tied to our core business or compensation.

Click Here to Discuss Your Situation with a Chevron Financial Professional